Alright, let’s talk about the Sensex and the Nifty. You probably saw the headlines: “Decline due to profit-booking, soft Asian cues.” But here’s the thing – that’s just the what. We need to dig into the why . What’s really going on behind the scenes, and what does it mean for you, sitting here in India, trying to make sense of it all?

The market’s a complex beast, isn’t it? It’s not just numbers on a screen; it’s a reflection of global sentiment, economic realities, and good old-fashioned human psychology. And right now, that psychology is leaning towards a bit of caution.

The Profit-Booking Puzzle | Why Now?

So, “profit-booking” is the buzzword. Makes it sound so simple, right? Investors taking profits. But it’s not that easy. Let’s be honest. Here’s the thing: after a sustained period of gains – and the Indian market has been on a pretty good run – some investors decide it’s time to cash in. Lock in those profits, take some chips off the table. Think of it like this: you’ve baked a delicious cake, and everyone’s had a slice. Now, before the cake disappears entirely, you want to make sure you get your share. According to experts, profit booking often happens at levels perceived as resistance points. This time around, the Nifty faced resistance around the 22,700 mark, triggering selling pressure.

But why now specifically? Well, a few things are likely at play.

First, the global economic outlook is still a bit shaky. There’s inflation in the US and Europe, and higher interest rates and geopolitical tensions continue to loom. While India’s economy is doing relatively well, we’re not entirely immune to global headwinds. Second, earnings season is wrapping up. With most companies having reported their results, there’s less immediate news to drive the market higher. It’s a bit like the lull after a big festival – everyone’s a bit tired and needs a break.

Soft Asian Cues | The Ripple Effect

Ah, yes, the “soft Asian cues.” This basically means that other major markets in Asia – think Japan, South Korea, Hong Kong – were also experiencing selling pressure. Here’s what fascinates me is how interconnected global markets are. What happens in one part of the world can quickly ripple across to another. When investors see weakness in other Asian markets, it can create a sense of unease and trigger similar selling in India. It’s a bit like a flock of birds – if one suddenly changes direction, the rest tend to follow. The impact of foreign institutional investors (FIIs) cannot be denied as they significantly contribute to the Indian stock market .

But why were they selling? Well, again, it’s a mix of factors. Concerns about China’s economic slowdown, rising interest rates in the US (which can make emerging markets less attractive), and geopolitical risks all contribute to the overall mood.

What Does This Mean for You?

Okay, so the Sensex and Nifty are down. Big deal, right? Well, it depends on your perspective.

If you’re a long-term investor – someone who’s investing for, say, 5, 10, or 20 years – then short-term fluctuations are just noise. They’re part of the game. Don’t panic. Don’t make rash decisions based on a single day’s trading. Stay focused on your long-term goals and keep investing regularly. A common mistake I see people make is trying to time the market. Trust me; it’s a fool’s errand. Even the professionals get it wrong most of the time.

If you’re a short-term trader, however, this kind of volatility can be both a risk and an opportunity. If you’re good at reading the market and managing your risk, you can potentially profit from these swings. But be careful! Trading is inherently risky, and you can lose money quickly if you’re not careful.

And if you’re just starting out, this is a good reminder that the market goes up and down. It’s not a one-way street. Don’t get carried away by the hype when the market is soaring, and don’t get discouraged when it dips. Stay disciplined, do your research, and invest wisely.

Looking Ahead | What to Watch For

So, what’s next? What should you be paying attention to in the coming days and weeks?

First, keep an eye on global cues. What’s happening in the US, Europe, and China will continue to influence the Indian market. Pay attention to economic data releases, central bank announcements, and geopolitical developments.

Second, watch out for any major domestic news or events. Government policy changes, corporate earnings announcements, and even the monsoon season can all have an impact on the market. Consider how the derivative segment impacts the market. The government is also keenly observing the stock market performance .

Third, and perhaps most importantly, stay calm and don’t let your emotions get the better of you. The market is inherently unpredictable, and there will be ups and downs. Focus on your long-term goals, stay disciplined, and don’t make impulsive decisions based on short-term noise. Check out this article for more information.

Let me rephrase that for clarity: Invest with a plan, not with your gut.

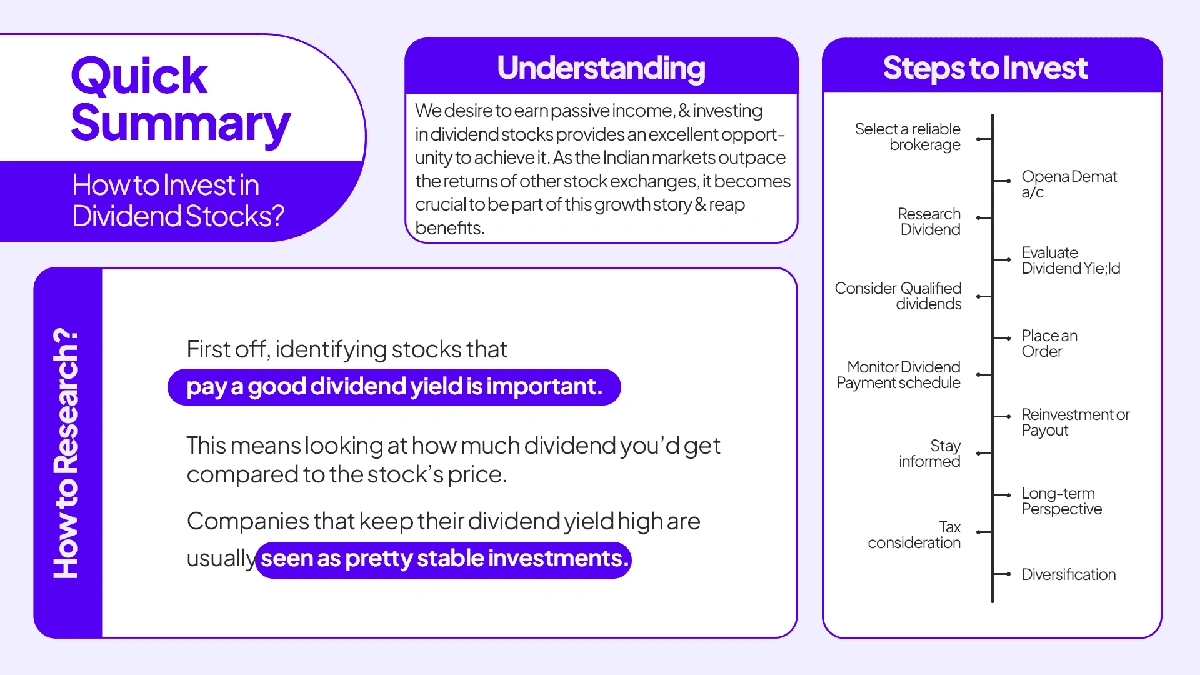

And hey, if you’re feeling overwhelmed, don’t be afraid to seek professional advice. A good financial advisor can help you navigate the complexities of the market and make informed decisions that are right for you. Also, consider diversifying your portfolio, which will minimize your risk profile. You can check out this for another investment perspective.

The Bottom Line

The Sensex and Nifty’s decline due to profit-booking and soft Asian cues is a reminder that the market is not a one-way street. Short-term fluctuations are normal and should not be a cause for panic, especially if you are investing for the long term. Stay informed, stay disciplined, and stay focused on your goals. And remember, the market is a reflection of the world around us – a world that is constantly changing and evolving. The Indian economy outlook plays a major role in deciding market trends.

FAQ

Frequently Asked Questions (FAQs)

What exactly does “profit-booking” mean?

It’s when investors sell their holdings to realize gains after a period of price appreciation.

How much should the Sensex and Nifty fall to consider it a “crash”?

There’s no single number, but a drop of 10% or more from recent highs is often considered a correction, and 20% or more a bear market.

What if I forgot my Demat account details?

Contact your broker immediately to recover the details.

Is it a good time to invest now?

Timing the market is difficult. Invest based on your risk tolerance and financial goals.

Will the market recover?

Historically, markets have always recovered, but past performance is not indicative of future results.

What is the impact of global market trends on Sensex and Nifty?

Global events and economic data directly influence investor sentiment and capital flows.